For a long time, most lithium is produced by oligopolies of producers commonly known as "three giants": Albemarle, Chile Chemical Mining Company and FMC. Rockwood Holdings was also on the list before it was acquired by Albemarle a few years ago.

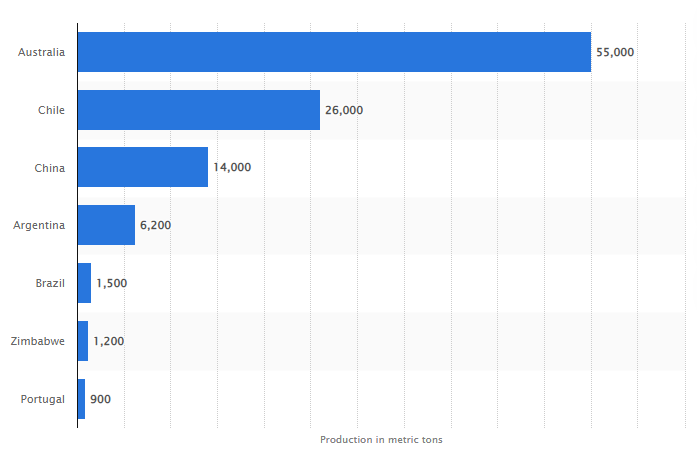

However, in recent years, the list of the world's top lithium mining companies has changed. Although the above-mentioned companies still produce most of the world's lithium, China also accounts for a large part. In terms of mine output, China is the third largest lithium producer in 2021, after Australia and Chile.

Lithium output in 2021

More importantly, the largest lithium mine in Australia, Greenbushes, is controlled by a joint venture between China Tianqi Lithium and Australian IGO. The joint venture owns 51% of the shares of Talison Lithium, while Albemarle owns another 49%.

According to S&P global market intelligence analysts, China is in the leading position in the global lithium processing and refining, but only accounts for about 12% of the global lithium raw material supply in 2020. In the future, China is expected to promote the production of lithium-ion batteries, which will increase significantly in the next few years.

In other words, lithium investors should pay attention to Chinese lithium mining companies in addition to the chemical companies that produce lithium listed in New York. The following are the seven largest lithium production companies in 2022.

Jiangxi Ganfeng Lithium is an important lithium producer in China, with a market value of 32.89 billion US dollars. It is the largest lithium compound producer in China and one of the largest lithium metal producers in the world in terms of capacity.

The mining company has lithium resources worldwide, including Australia, Argentina, China and Ireland. However, the main source of lithium raw materials is Mount Marion in Western Australia.

The company was listed in Hong Kong in 2018. In the same year, it acquired the shares of SQM, a Chilean mining and chemical company, in the American lithium industry, Lithium Americas, located in the Cocchary-Oraroz brine lithium project in Argentina. In February 2020, Gan Feng raised its equity in Cocchary Olaroz to 51% and obtained the controlling right of the asset.

Ganfeng also signed supply agreements with Elon Musk's Tesla, BMW, Korean battery manufacturer LG Chem and Volkswagen.

In 2021, Ganfeng will continue to expand its business scale. The company agreed to purchase the shares of Bakanola Lithium, which focuses on Mexico, with US $264.5 million; It also bought the shares of Malian lithium mine for US $130 million and a salt lake in China for RMB 1.47 billion.

Tianqi Lithium, a lithium producer, is a subsidiary of Chengdu Tianqi Industry Group, headquartered in China, and is the largest hard rock lithium producer in the world, with a market value of $23.03 billion. The company's assets are distributed in Australia, Chile and China.

In 2012, Tianqi defeated Rockwood Holdings and took control of Talison Lithium, which in turn took control of the Greenbushes mine in Australia. However, it subsequently sold 49% of Talison's equity to Rockwood Holdings. As mentioned earlier, the company is now owned by Albemarle.

In September 2016, Tianqi spent $209.6 million to acquire 2.1% of the shares of SQM, and then increased to 23.77% at the price of $4.07 billion in 2018.

The company also developed a lithium hydroxide plant in the Quinana Industrial Zone, south of Perth, Western Australia. In 2019, Tianqi suspended the expansion plan of Quinana lithium hydroxide plant, taking stable production as the priority. The factory began production in the third quarter of 2019 and in the middle of 2021.

In 2020, Tianqi sold its shares in Australian assets to IGO in a $1.4 billion deal, which provided a boost for the Chinese company in financial distress. With the rise of lithium price, Tianqi Motor recovered its profit in the second quarter of 2021, and the third quarter hit the highest quarterly net profit since the end of 2018.

Albemarle is one of the largest lithium producers in the world, with a market value of 22.47 billion US dollars and 5000 employees and customers in 100 different countries around the world. In addition to lithium, Albemarle also produces bromine and provides refining solutions and chemical services for pharmaceutical companies.

When Albemarle completed the acquisition of Rockwood Holdings in early 2015, it became a heavyweight company of lithium battery. The company has lithium brine business in the Clayton Valley near Silver Peak in the United States and the Atacama salt marsh in Chile; As mentioned earlier, it also owns 49% of the shares of the large hard rock Greenbushes mine.

In 2018, Albemarle announced that its request to increase lithium quota had been approved by the Chilean government organization Corfo. The company is now authorized to produce up to 145000 metric tons of lithium carbonate equivalent annually in Chile until 2043.

Albemarle subsequently signed an agreement with Mineral Resources to invest US $1.15 billion. The joint venture will own and operate the Vagina hard rock lithium mine in Western Australia. In 2019, the company started construction of the Kemerton lithium hydroxide processing plant near Perth.

At present, the company's La Negra III and IV processing facilities in Chile are in the stage of commercial certification, while the Kemerton plant in Australia should achieve commercial production in 2022 after about six months of commissioning and certification.

Chile Mining and Chemical Company claims to be a leader in lithium and derivatives, with 19% market share, and has offices in more than 20 countries around the world, with customers in 110 countries around the world. The company has five business areas, from lithium to potassium to special plant nutrition, with a market value of about 19.98 billion dollars.

The main lithium business of Chile Mining and Chemical Corporation is located in Chile. The company has spent a lot of time fighting with Corfo of Chile on the lease of the Atacama salt marsh where its lithium salt water business is located. After many failed meetings, SQM and Corfo reached a resolution in the middle of January 2018.

In 2016, SQM, a Chilean mining and chemical company, and Lithium Americas, an American lithium stock, announced that it would develop the Cocchary-Oraroz lithium project in Argentina through a joint venture, marking the first time SQM invested in raw materials outside Chile. Two years later, Ganfeng acquired the shares of SQM in the project.

Outside South America, SQM is jointly developing the Dutch Mountain Lithium Project in Australia with Sinang Group, which is known as one of the largest hard rock deposits in the world. Acquisition of Kidman Resources, an Australian lithium mining company.

Pilbara Minerals, which is listed in Australia, operates its 100% owned Pilgangoora lithium tantalum assets in Western Australia, with a market value of $5.89 billion. The business includes two processing plants: Pilgan plant, located in the north of Pilgangoora area, which produces spodumene concentrate and tantalum concentrate; And Ngongaju plant in the south, which produces spodumene concentrate.

The company realized commercial production in 2019 and established partnerships with Ganfeng Lithium, General Lithium, Great Wall Motors, POSCO, Ningde Times and Yibin Tianyi

In 2021, Pilbara Minerals acquired Altura Lithium with $155 million in cash. In January 2022, due to the strong demand for lithium, the company announced a profit of AUD 114 million in the first half of the year.

Allkem was founded after the merger of Orocobre in Argentina and Galaxy Resources in Australia with a market value of US $4.17 billion. Allkem, headquartered in Buenos Aires, Argentina, is an industrial chemical and mineral company that operates lithium, potash and boron projects and facilities portfolio in Pune, northern Argentina.

The company, in cooperation with the investment departments of Toyota Tongshang and Jujuy government, built the first large, new, salt-based lithium project in Salar de Olaroz in about 20 years, and plans to produce 42500 tons of low-cost lithium carbonate annually.

In addition, Allkem and Toyota Tsusho have begun to build a lithium hydroxide plant with an annual output of 10000 tons in Nara Port, Japan. Pre-commissioning is in progress, and the company's goal is to start operation by the beginning of 2022, and comprehensively improve after 12 months.

Allkem has also been promoting the plan to develop Sal de Vida lithium salt and potash projects in Argentina. It also owns Mount Cattlin mine in Western Australia, which is currently producing spodumene and tantalum concentrate, and James Bay pegmatite lithium project in Canada.

Livent was separated from FMC in 2018, with more than 900 employees worldwide and manufacturing bases in the United States, the United Kingdom, India, China and Argentina. The company has a lithium business in Salar del Hombre Muerto, Argentina, with a market value of 3.73 billion US dollars. It has been extracting lithium there for more than 20 years. The lithium carbonate produced is used as the raw material for lithium hydroxide production downstream of Livent. Livent is also producing qualified battery grade lithium hydroxide in the United States and China.

In 2021, Livent resumed its capacity expansion projects in the United States and Argentina, which benefited from the implementation of recent long-term supply agreements, the improvement of market prospects and the continuous support of local governments and communities. At the beginning of 2022, the company outlined the second capacity expansion plan. Once completed, its Argentine business will reach 60000 metric tons of lithium carbonate and 9000 metric tons of lithium chloride.

In addition to the world's top lithium producers, many other companies are producing this key raw material for electric vehicles. Including: Jiangxi Special Electric Machinery, Mineral Resources, Sichuan Yahua Industrial Group and Yongyi.